Nvidia's Meteoric Rise in Market Value

Nvidia, formerly known primarily as a graphics processing unit (GPU) manufacturer, has seen an unparalleled rise in its market value, surpassing titans like Apple and Microsoft. This development marks a significant milestone not just for Nvidia, but for the technology landscape as a whole. Nvidia's market capitalization has soared past $1.3 trillion, fueled largely by dramatic increases in the demand for GPUs and artificial intelligence (AI) technology. It's a story of how the company, under the visionary leadership of CEO Jensen Huang, has strategically diversified its portfolio, placing huge bets on AI and data-centric applications that are now paying off in a big way.

Nvidia's achievements can be attributed to a combination of market savvy, technological innovation, and strategic foresight. While many companies that specialize in one area often find it challenging to diversify their offerings successfully, Nvidia has managed to do just that. From gaming and data centers to autonomous vehicles and sophisticated AI applications, Nvidia's influence is pervasive. The company's GPUs are essential for rendering high-quality graphics and processing complex computations, making them indispensable across a wide range of industries.

The Role of GPUs and AI in Nvidia's Success

The escalation in Nvidia's stock price, which has surged by more than 50% over the past year, underscores the pivotal role that GPUs and AI technologies play in today's digital economy. This growth isn't just about gaming anymore—although Nvidia's GPUs have long been a favorite among gamers for their exceptional performance. In recent years, the application of these technologies has expanded far beyond recreational uses, making vital contributions to data centers, scientific research, and autonomous vehicles. In particular, the rise of AI has underscored the need for powerful computational capabilities, something Nvidia's GPUs are uniquely equipped to provide.

Nvidia's dominance in the GPU market is nothing short of staggering. Holding a 90% market share, the company has cornered a crucial technology sector, becoming an indispensable resource for developers and corporations alike. The exponential growth in data and the complexity of modern computations necessitate powerful GPUs, and Nvidia has proven itself the go-to name in the industry. The company's GPUs are embedded in various ecosystems, from data centers and high-performance computing clusters to personal gaming rigs and mobile devices.

Strategic Diversification into AI and Data Centers

Nvidia's strategic moves to diversify into AI and data centers have been critical elements of its growth strategy. These sectors are experiencing explosive growth, driven by advancements in machine learning, big data, and cloud computing. Nvidia's GPUs provide the computational horsepower necessary to train AI models and process enormous datasets, making them invaluable tools for tech firms and enterprises. The company's robust portfolio of AI solutions includes everything from accelerated computing platforms to sophisticated software tools designed for deep learning and neural networks.

In the realm of data centers, Nvidia has made strategic acquisitions and investments to bolster its offerings. The growing demand for data-intensive applications, such as real-time analytics, video streaming, and interactive gaming, has precipitated a need for high-performance computing solutions. Nvidia's GPUs serve as the backbone for many of these applications, enabling companies to scale their operations efficiently and cost-effectively. The company's investments in AI-powered data centers have not only enhanced its market position but also opened up new revenue streams.

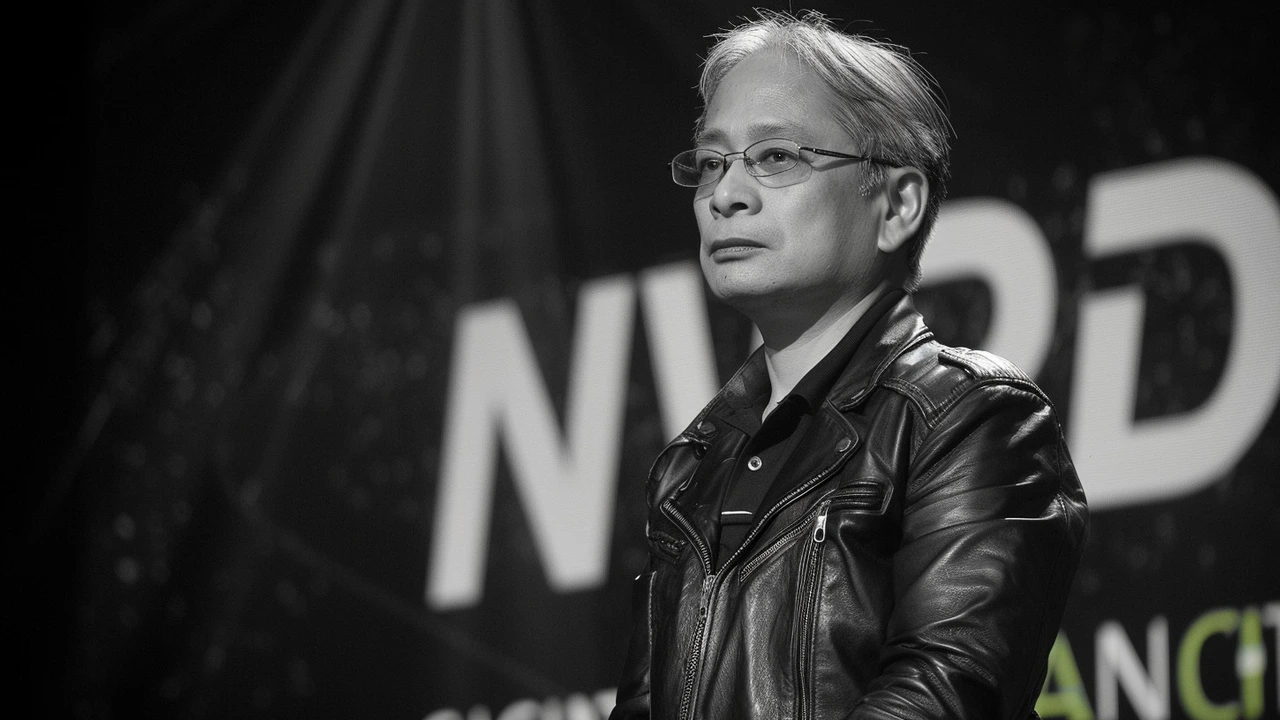

Leadership Under CEO Jensen Huang

Underpinning Nvidia's remarkable ascent is the visionary leadership of CEO Jensen Huang. Since co-founding Nvidia in 1993, Huang has been instrumental in steering the company through numerous technological shifts and market cycles. His vision for a future where AI and computing converge has been a driving force behind Nvidia's strategic direction. Huang's ability to foresee technological trends and make bold investments has redefined what is possible in computing, placing Nvidia at the forefront of several high-growth sectors.

Huang has consistently been ahead of the curve, recognizing early on the transformative potential of GPUs beyond gaming. His foresight in investing heavily in AI and data center technologies has paid off spectacularly, positioning Nvidia as a critical player in the tech industry's future. Huang's leadership style is characterized by a willingness to take calculated risks and an unwavering commitment to innovation. Under his guidance, Nvidia has transitioned from a graphics card manufacturer to a diversified tech giant shaping the future of computing.

The Disruption of Traditional Industry Giants

Nvidia's triumph highlights a broader trend in the technology landscape: the ascendancy of companies focused on emerging technologies. As Nvidia vaults past industry stalwarts like Apple and Microsoft, it underscores the shifting priorities in tech investment. Companies that are at the cutting edge of innovation, particularly those that specialize in AI, big data, and cloud computing, are gaining prominence. These sectors are becoming increasingly vital as the world moves towards a more interconnected and data-driven future.

The rise of Nvidia as the world's most valuable company signifies a paradigm shift in how value is generated and perceived in the tech industry. While traditional giants like Apple and Microsoft have dominated for years with their consumer electronics and software solutions, Nvidia's success illustrates the growing importance of specialized, high-performance technologies. Investors and market analysts are taking note, recognizing that the companies poised to shape the future will be those that can push the boundaries of what technology can achieve.

Future Outlook and Implications

The future looks incredibly promising for Nvidia, but it also comes with its set of challenges. As the company continues to grow and evolve, it will need to navigate an increasingly competitive landscape. Other tech firms are keenly aware of Nvidia's success and are investing heavily in their own GPU and AI initiatives. Moreover, regulatory scrutiny and supply chain issues could pose obstacles to sustained growth. However, Nvidia's track record of innovation and strategic foresight positions it well to meet these challenges head-on.

Looking ahead, it is clear that Nvidia will continue to play a pivotal role in shaping the future of technology. Its contributions to AI, data centers, and GPUs are already transforming industries and creating new possibilities. As more applications for these technologies emerge, Nvidia is poised to capitalize on new opportunities and drive further advancements. The company's success serves as a testament to the power of strategic vision and the importance of staying ahead of market trends.

Conclusion

Nvidia's remarkable rise to become the world's most valuable company is a story of strategic innovation, market dominance, and visionary leadership. From its origins as a GPU manufacturer to its current position as a tech giant at the forefront of AI and data center technologies, Nvidia has consistently pushed the boundaries of what is possible. With a market capitalization exceeding $1.3 trillion and a stock price that continues to soar, Nvidia's influence on the technology landscape is undeniable. As the world continues to embrace the possibilities of AI and high-performance computing, Nvidia is well-positioned to lead the charge into a new era of technological innovation.

June 22, 2024 AT 02:58

It's wild how a company that started with gaming cards ended up powering the future of computing. Kinda poetic, honestly. 🤖✨

June 22, 2024 AT 09:43

This is such an inspiring story! If you believe in tech and keep learning, you can change the world. Keep going, everyone! 💪🚀

June 22, 2024 AT 17:56

They're not really worth it

June 23, 2024 AT 21:49

I mean… I just bought a new RTX 4090 last month and now I feel like a genius. 😅 The future is here and it’s got a GPU inside.

June 25, 2024 AT 10:07

Nvidia’s dominance isn’t just luck. Their CUDA ecosystem is like the Android of AI-once you’re in, you’re stuck. And honestly? It works. No other company comes close.

June 25, 2024 AT 13:28

You think this is real? Nvidia’s market cap is being pumped by hedge funds using AI-generated news bots. The whole thing’s a front. The Fed’s printing money and calling it ‘innovation’. Wake up. The GPU shortage? Manufactured. The chips? Made in Taiwan under Chinese control. This is a trap.

June 25, 2024 AT 16:35

The rise of NVIDIA reflects the global shift toward technological sovereignty. Nations investing in AI infrastructure will lead the next decade. Nigeria must prioritize local GPU adoption and training programs.

June 26, 2024 AT 14:02

We have reached a point where value is no longer measured in tangible goods, but in the ability to simulate consciousness. Nvidia isn't just a company-it's the architect of a new ontological layer in human civilization. What does it mean to be valuable when intelligence can be bought and sold in teraflops?

June 27, 2024 AT 00:41

Let’s be real-this is just another tech bubble inflated by retail investors who don’t understand tensor cores. Apple and Microsoft have real products. Nvidia? They sell expensive bricks to data centers run by people who don’t know how to code. Pathetic.

June 27, 2024 AT 21:26

Honestly, it’s embarrassing that we’re celebrating a company that made its name selling graphics cards for Fortnite. The real innovation is in quantum computing, or at least in open-source AI frameworks that don’t rely on proprietary black boxes. Nvidia’s monopoly is a threat to open innovation. Jensen Huang is a modern-day monopolist playing god with compute power. And don’t even get me started on how they lock developers into CUDA like a corporate cult.

June 28, 2024 AT 16:08

This is proof that passion + persistence = legacy. If you’re building something you believe in, even if people laugh at first, keep going. Nvidia didn’t start as a giant-they started with a dream and a chip. You got this. 🙌

June 30, 2024 AT 05:22

So we’re now living in a world where the company that made your gaming rig also trains the AI that writes your emails. Cool. I guess we’re all just NPCs now. 🤖☕️

June 30, 2024 AT 07:01

In India, we’ve always had a love-hate relationship with tech giants. We worship them, then we complain they’re too American. But Nvidia? They’re the first company that didn’t just sell us a product-they sold us a future. The same way Silicon Valley once sold us the internet, Nvidia’s selling us the brain. And honestly? It’s beautiful.

June 30, 2024 AT 12:00

i just bought a 4070 ti super and now i feel like a genius 😅😅 maybe i should invest in nvda? idk just saying

June 30, 2024 AT 23:51

This is incredible! 🎉🔥 The future is bright and powered by GPUs!

June 20, 2024 AT 22:03

NVIDIA JUST DETHRONED APPLE??? 😱 This is the end of capitalism as we know it!!! I told you all this AI hype was a bubble!!! 🤯💸