Market Value: What It Means and Why It Matters

When you hear the term market value, think of the price people are willing to pay for something right now. It could be a company’s shares, a football player’s contract, or even a piece of land. In everyday news, market value shows up in headlines about tax reforms, big transfers, or stock moves – basically anything that has a price tag.

Why should you care? Because market value tells you how the world values a resource at this moment. If a club pays a record fee for a striker, that fee is a market value signal for other clubs. If a country changes its tax rules, businesses will see their market value shift overnight. Knowing the basics helps you read the news with less confusion and more confidence.

How Market Value Impacts Companies and Investors

For a company, market value is usually the total worth of all its listed shares. When the Finance Bill 2025 in Kenya proposes new tax rules, investors instantly recalculate the market value of local firms. A lower tax on digital assets, for example, can push the market value of tech startups higher because investors expect higher after‑tax profits.

In the sports world, market value works similarly. The transfer saga around Victor Gyokeres shows how a club’s asking price reflects what the market believes the player is worth. If Arsenal or Manchester United finally agree on a fee, that amount becomes a benchmark for any future deals involving Swedish strikers.

And it’s not just big names. Even smaller moves, like a local drug seizure worth R10 million in Durban, can affect the market value of companies in the pharmaceutical supply chain. When law enforcement cracks down, risk goes up and market value can dip because investors see higher uncertainty.

Tracking Market Value in Everyday News

The good news is you don’t need a finance degree to stay on top of market value changes. Look for three cues in any story:

- Numbers – Any headline with a figure (R10 million, €65 million, $150) is giving you a market value clue.

- Regulation – New laws, tax bills, or court rulings usually shift market values fast.

- Demand – When a player is linked with multiple clubs or a tech startup gets a funding round, demand pushes the market value up.

Take the recent BetMGM bonus code ROTOBG150 promotion. While it’s a betting offer, the $150 bonus tells you how much the sportsbook thinks bettors are willing to spend on big events like UFC 316. That figure is a micro‑market value for betting interest.

In Africa, tracking market value also means watching local currency shifts. The Kenyan Finance Bill’s VAT changes affect how firms price goods, which in turn changes the perceived market value of those products. If you’re following business news, keep an eye on the currency symbols – they often hint at broader market value trends.

So next time you scroll through Russ Africa Daily and see a headline with a big number, remember it’s more than a headline. It’s a snapshot of market value at that moment, and it can help you understand where the economy, sport, or entertainment sector is heading.

Stay curious, keep checking the numbers, and you’ll turn market‑value chatter into useful insight for your daily decisions.

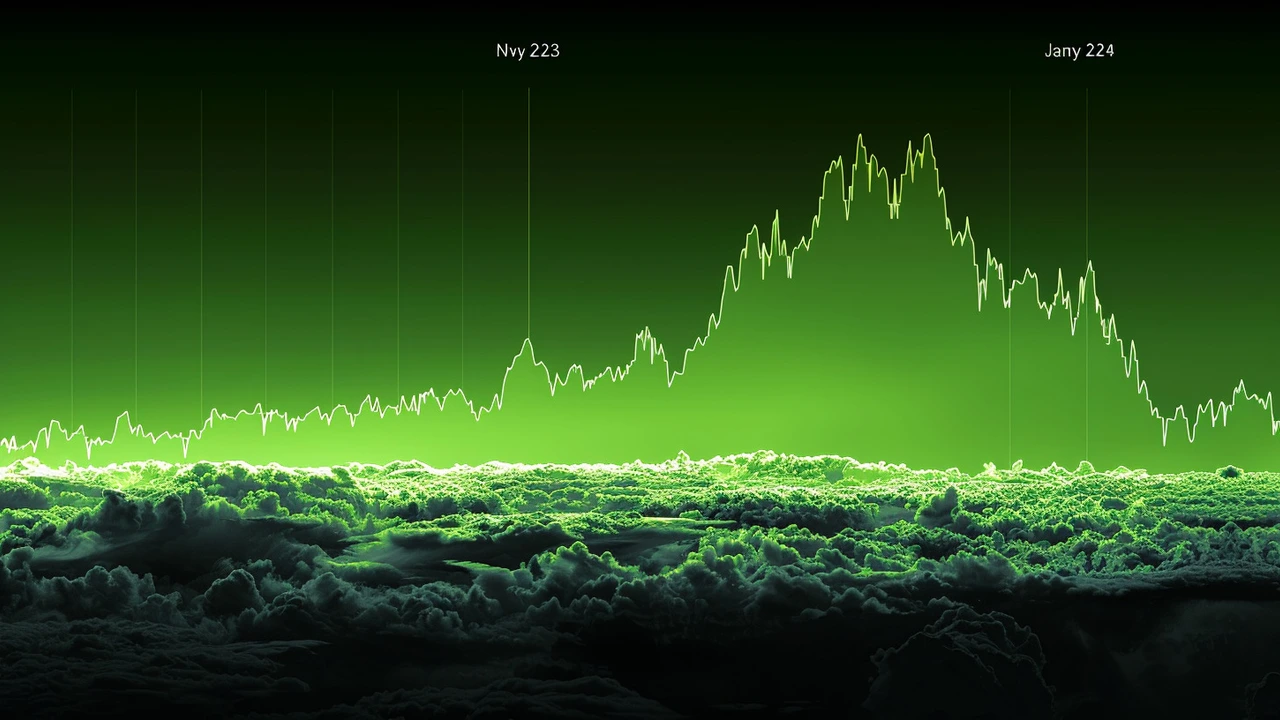

Nvidia Takes the Lead as the World's Most Valuable Public Company, Surpassing Tech Giants Apple and Microsoft

Nvidia has surged ahead of tech giants Microsoft and Apple to become the world's most valuable public company, achieving a remarkable market capitalization of $3.34 trillion. This rise is powered by its critical role in AI technology, with shares skyrocketing 700% since the launch of ChatGPT. Nvidia dominates the AI chip market, creating unprecedented demand for its product and setting a new benchmark in the tech industry.

View More